How to move Hydrogen

Moving molecules in high volume is the hardest part to get cost-effective in hydrogen. Without any clear path to build on existing infrastructure, the hydrogen economy doesn’t take off. That’s why the DOE commercial liftoff report, which I was co-lead author on, indicated that shared pipelines are one of the most crucial parts of commercial liftoff for hydrogen, and why many of the hubs are likely to have common carrier pipelines.

Until we have pipelines, the picture is much more complicated:

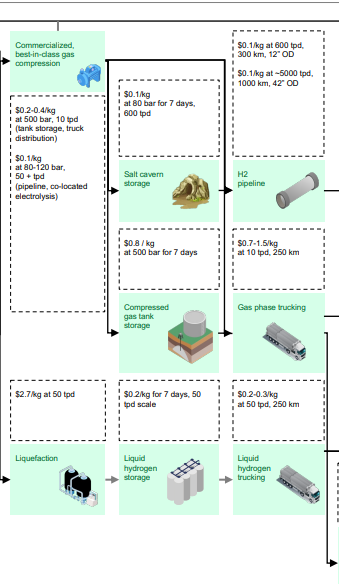

H2 midstream pulled from the DOE H2 Commercial Liftoff report (which I was one of the lead authors of)

While you can see many ways above to move and store hydrogen, ultimately we don’t succeed without at least regional hydrogen pipelines – any other method is either for small-scale uses or is an expensive stop-gap.

It’s always important to consider how this stacks up to other ways of moving energy. Moving hydrogen is harder than moving natural gas, much harder than moving petroleum, and, at scale, much easier to move than electrons.

Distribution is the hard part of hydrogen. If we can’t get this right, hydrogen doesn’t happen.

First, some history– the earlier days

We’ve been moving hydrogen mixtures in pipelines since the 1800s. Town gas was created by gasifying coal and cleaning it. It was up to 55% H2 with some other gases mixed in. This has been around since the early 1800s. As we developed better methods of mining natural gas and oil, the use of coal to create hydrogen has dropped off (except in some countries). Hawaii currently can use up to 30% hydrogen in their natural gas grid. We have had high purity hydrogen pipelines for decades now in the gulf coast and Northwest EU. The only new parts are expanding these various use cases to regional and national grids and making them open access.

How me move hydrogen now

In order of volume:

1. Most hydrogen is used by co-located facilities – the production is next to the end user

2. Second is moving H2 in pipelines in massive chemical and refining regions life the gulf coast, Saudi Arabia, and Northwest EU

3. Third is liquefying it and moving it as a liquid in a cryo tanker truck

4. Fourth, barely used at all currently but potentially a low-cost method, is moving it in compressed gaseous tanker trucks

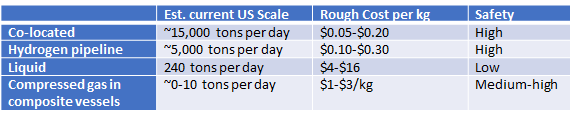

Liquid hydrogen is one to two orders of magnitude more expensive than pipeline and up to an order of magnitude more expensive than gaseous.

In a bit more detail:

Co-located facilities

Most hydrogen is used nearby to where it is produced. Typically natural gas is delivered to a region like the US gulf, it is converted to H2 and CO2 via steam methane reforming, and then the offtaker is next door. This is about as safe as you can get – the hydrogen is fully contained within a high-security and high-safety facility. A single plant like this will produce and use 300 tons per day – more than our entire US liquid hydrogen distribution capacity. We use about 30,000 tons of H2 in the US per year, and somewhere over half of that is adjacent use.

Hydrogen pipelines

There are about 2500 miles of hydrogen pipelines in the world, mostly in the US gulf coast and in Germany/Netherlands. None of these are extended networks like we have for the natural gas pipeline – there are no “pumping stations” to repressurize hydrogen pipelines to keep the gas moving, whereas these are common in natural gas. There is some maturing of this technology needed to bring it into the 21st century compared to our 19th century town gas hydrogen pipelines.

These pipelines are currently solely owned by individual companies and there is no mandated shared access that we enjoy with nat-gas pipelines.

Liquefaction – liquefied hydrogen (LH2)

Current contracted costs to buy and have delivered liquefied hydrogen in the west coast of the US range from $12-$30, a notable deviation from DOE’s estimated costs above. There are many reasons for this, including limited supply and the delivery companies jacking up prices an insane amount, but one main one reason is that LH2 at this scale is expensive and always will be.

To liquefy hydrogen it has to be brought to 20 degrees above absolute zero at -253C and the molecule needs to go through a quantum transition whereby the spin of one of the electrons is flipped. Compare to liquid natural gas at -160C and with no wild quantum transitions – LH2 is complicated and expensive.

Small-scale use cases of less than tens to hundreds of tons a day are moved by liquid in the US. In EU, it’s moved as compressed gas.

The EU has hardware to move 1 ton of hydrogen at a time as compressed gas there is only 20 tons per day of hydrogen liquefaction capacity. US DOT rules don’t allow for equipment that can move 1 ton of compressed gas– mostly because US DOT doesn’t have any hydrogen expertise and they’ve punted. As a result, the US have between 250 and 400 tons per day of hydrogen liquefaction capacity.

Liquid doesn’t really make sense if you have the capability of putting 1 ton of compressed H2 onto a truck. Unfortunately, the US DOT doesn’t even have a process in place to certify these trucks.

Compressed Gaseous Hydrogen

In current practice in the US, compressed gaseous hydrogen is moved at 200-500 atmospheres in steel trailers. These trailers can hold 200kg of H2. Owing to a difference in what is road-legal, 1000kg of H2 can be moved in aluminum cylinders in the EU.

New hardware can compress the gas to 550-700 atmospheres in carbon fiber tanks on trailers. If these trailers are swapped at the end-use site, the cost to transport the hydrogen could be on the order $1/kg. In addition, if these tanks are swapped, the hydrogen is high-pressure and can be used for high-pressure end-uses like fueling with significantly less onsite compression, drastically reducing cost and complexity.

The real cost analysis - LH2 makes no economic sense unless the end use requires it

Shown below are two versions of the same info – the first is the DOE commercial liftoff report calculations assuming a 1 ton gaseous truck vs a 3.5-5 ton liquid truck. The second is the similar, except with a lot more details and the round-trip distance as opposed to one-way distance in the X axis.

The DOE version is fuzzy to represent error bar. The cutoff distance in the DOE version was the time limit that a truck driver is allowed to go in a single day – 9 hours of actual driving. Generally speaking, once the DOT approves carbon fiber trailers in the US there is no regime in which liquid hydrogen will be used to deliver hydrogen within 250 miles of a production site unless LH2 is absolutely needed for the end use. Liquid hydrogen moves 3-4x the H2, so even with higher cost it starts to make sense to have team drivers. Without these limitations, the analysis showed that liquid hydrogen costs only start to compete with gaseous at about 1000 miles one-way. Note that if we ever have autonomous trucking, it’s likely that liquid hydrogen will not be used as a way to move hydrogen, but will only be used if the end use requires hydrogen.

The DOE Commercial Liftoff report analysis of costs of hydrogen distribution, assuming we have carbon fiber tube trailers

A much more detailed version - that I wrote the code for on my own time in 2019

Here is a more detailed version I made as a side project in 2019. The white line is where we were before the advent of carbon fiber tube trailers with everything to the right being “more cost effective to move as a liquid”. The blue line is where we shift to. As you can see, there is no regime where LH2 is the least-cost where the cost to make and transport LH2 is less than $4/kg. This is also using a 7% cost of capital which almost no one is getting. Add another dollar to the listed LH2 prices with current cost of capital - keep GH2 the same price since GH2 is an OpEx play.

The DOE liftoff report (the prior image) repeated all the work and modeling I put into my version. While at the DOE I spent weeks walking experts through the work I had done, introduced them to the private sector companies that were working on the hardware to make this happen, got everyone semi-comfortable with the idea, and was able to push this through for the DOE version above for the final commercial report. On a personal note, this was initially a side project (I made it in Python using ML tools, things that corps typically don’t allow, so it was a personal project). Then I brought it to work where the results took months to validate and socialize. I was the first one to make public that carbon fiber tube trailers for GH2 would render liquid hydrogen too expensive as a small-scale distribution method - making LH2 necessary only if an and use must use LH2. The implications here pushed the major projects in H2 in the EU to be gaseous (other than Linde-Daimler), and generally assured that the future of moving H2 in the EU is gaseous up until their H2 Backbone is developed.

The moral of the story: compressed gaseous hydrogen is the least-cost way to locally produce and move hydrogen at scales that aren’t industrial. Given that most new offtakers will be using small amounts of hydrogen rather than 300 tons per day, compressed gaseous hydrogen distribution is vital to the expansion of the hydrogen economy in advance of pipelines.

Wrapping it up

Getting to pipelines will require either a massive investment (think DOE H2Hubs) or a smaller-scale distribution method to reach the scales of pipeline. LH2 is not that method - there will be no new scalable small-scale offtake from LH2 given its cost.

In the US, the major gating item is now the US Department of Transportation to expand the allowable use of high-pressure GH2. There is no standard process of pathway to approve of new hydrogen pressure vessels, so it’s all bespoke, extremely costly, and somewhat capriciously up to whoever gets the case. Once DOT makes this change, expect the US to enjoy the same low-cost gaseous hydrogen distribution that the EU has for years. If DOT doesn’t make the change, expect the DOE hydrogen hubs to be the last stand for the US to develop any hydrogen ecosystem.

Appendix

Other ways of moving hydrogen

Ammonia

In the EU the generally consensus seems to be “ammonia is a good hydrogen vector now—we will need a better one later and it could be large-scale LH2.” In the US we are still stuck on ammonia because we don’t have to deal with it on the delivery side. Ammonia loses 15% or more of its energy on the other side if converted back to hydrogen – a problem if you are delivering it as fuel to an energy-poor area. Using ammonia directly without reconverting to H2 is great energetically, but using ammonia directly is problematic – particularly as a vehicle fuel. It turns out that exposure to 0.1% ammonia vapors will kill you in a few minutes, so using it in vehicles that frequently crash is not advised.

Liquid Organic Hydrogen Carrier (LOHC)

Nothing about this makes sense. The carrier itself is expensive and has to be regenerated frequently, the weight percent of the carrier requires a significantly larger number of ships to move the H2, and it must be converted at the end by providing a prodigious amount of heat to the LOHC at the end site. The offgas rate of getting the hydrogen out of the LOHC is also terrible, so the expensive carrier and the equipment to offgas the H2 don’t get well capitalized. The money just doesn’t work out. To me, LOHC is the zombie that just can’t be put down. New catalysts might change that, but until I see further details I’m not convinced.

Methanol and other products

If the end use of a hydrogen derivative is the derivative, these can work out economically. Right now, however, sourcing sufficient zero-emission carbon—IE not from fossil fuels, but from a renewable source or pulled directly from the atmosphere) is— is too expensive. Getting enough plant matter for biological origin carbon is also a problem - the cost-effective scale of these systems would strip a very large area of all plant life just to feed one plant. If these issues are solved, then zero-emission derivatives could be fantastic - though they will never be as cost effective as the current processes and will require some carbon tax or fossil ban to make them commercially viable compared to their fossil brethren.

Large-scale liquid hydrogen

Size matters. Thermal and thermogenic processes get much more capital efficient at mega scales. Comparing daily energy output, a LNG liquefier is 100x larger than the largest of hydrogen liquefiers. Plug’s and the Industrial Gas Companies move from 30 ton per day liquefiers to 45 ton per day liquefiers is not going to bring the cost of liquid hydrogen down. We need a 10x scale-up and another 10x scale-up. There are only a few companies in the world that can do this, and their names don’t start with the word “Air.” By 2030/35 we will know whether mega-scale liquid hydrogen could replace all other carriers.

[1] These are very rough estimates. This is a notoriously opaque industry that doesn’t share info